Benchmarking compensation in Family Offices has always been a challenge. The unique and highly personalized nature of these entities makes it very difficult to find reliable data, even as they continue to evolve into sophisticated, professionalized entities. Many who enter the Family Office space come from structured industries such as financial services or professional services, where clear compensation frameworks are the norm, further highlighting the need for accurate and transparent benchmarks.

The Global Family Office Compensation Benchmark Report 2025, developed in collaboration between Agreus Group and KPMG Private Enterprise, is designed to meet that need. This was built on the huge success of the 2023 edition, which was widely recognized as an invaluable resource across the industry.

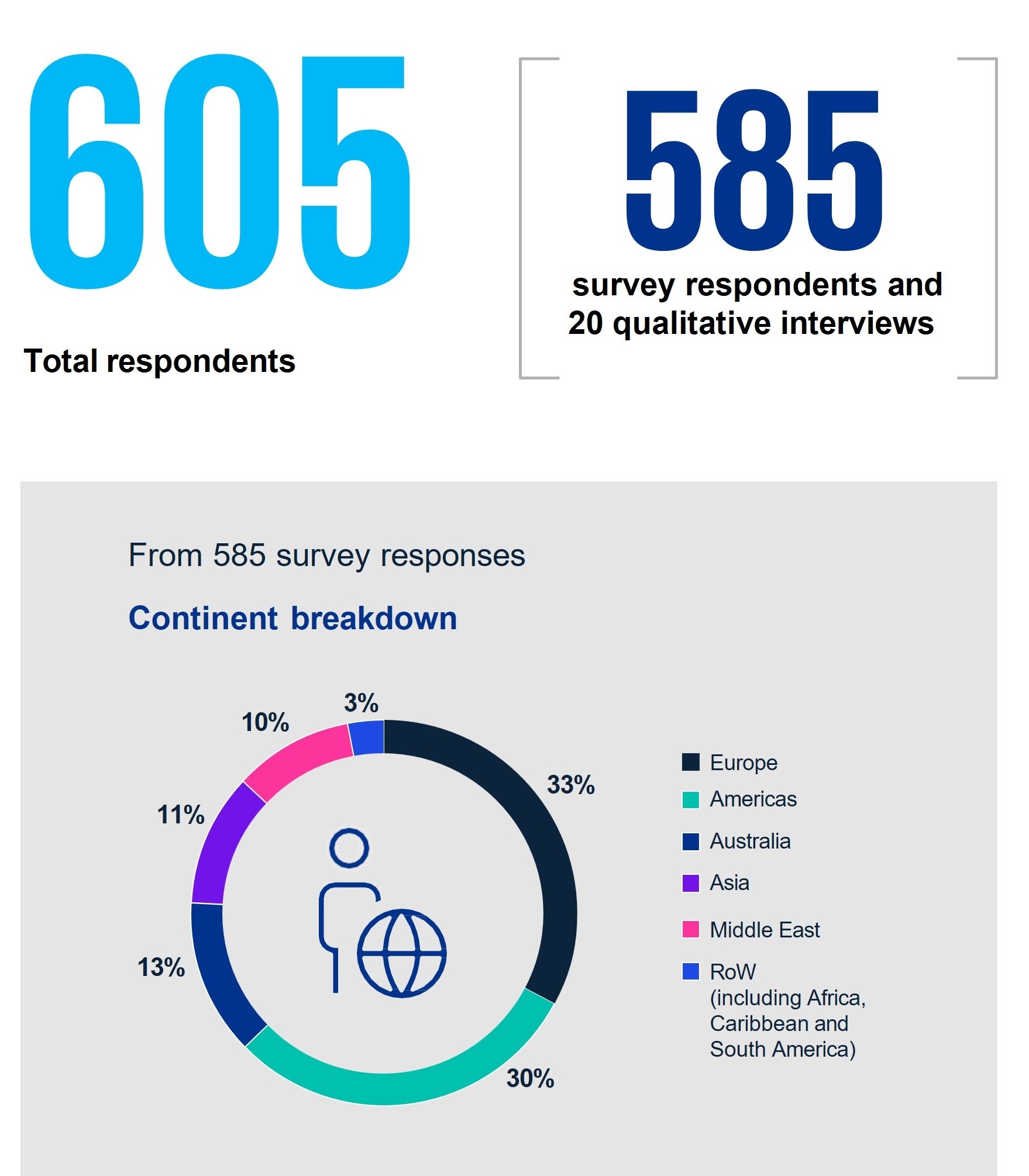

This year’s report draws on the contributions of 605 Family Office professionals, from Personal Assistants to Investment Professionals to C-Suite executives, had all participated in this comprehensive global survey. It is further strengthened by 20 in-depth interviews with senior leaders, across all regions.

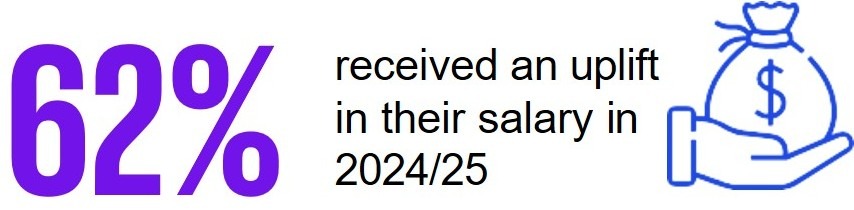

Together, these findings create a truly global picture of compensation, recruitment, investment and governance practices, as well as the overall trends, offering Family Offices the actionable insights required to attract, reward and retain top talent.

The Global Family Office Compensation Benchmark Report 2025, developed in collaboration between Agreus Group and KPMG Private Enterprise, is designed to meet that need. This was built on the huge success of the 2023 edition, which was widely recognized as an invaluable resource across the industry.

This year’s report draws on the contributions of 605 Family Office professionals, from Personal Assistants to Investment Professionals to C-Suite executives, had all participated in this comprehensive global survey. It is further strengthened by 20 in-depth interviews with senior leaders, across all regions. The Global Family Office Compensation Benchmark report represents the combined findings from both the survey and the interviews.

Professionalization, progress and the push for governance

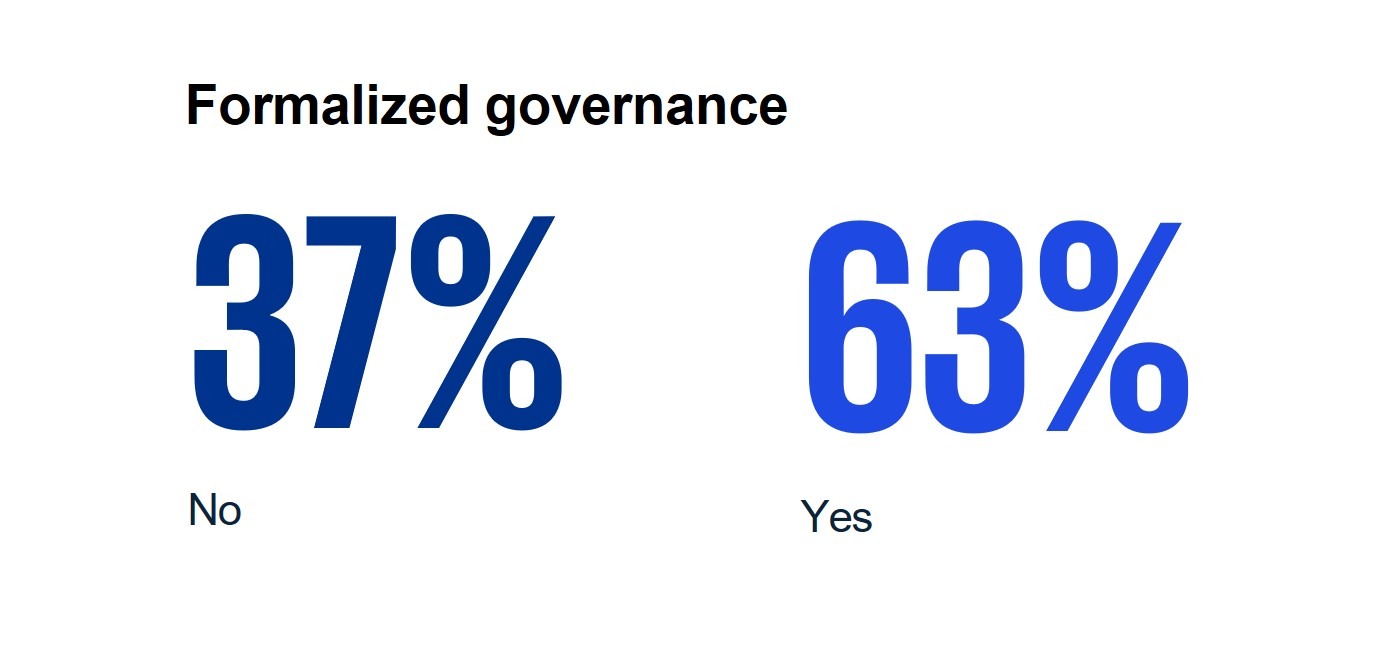

One of the key trends highlighted in the report is the increasing professionalization of Family Offices, with more Family Offices now established as standalone entities. This shift marks a broader movement toward enhanced governance and a deep understanding of the role of a Family Office. Wealth preservation was the most stated objective in the report and this signals a more strategic, long-term mindset, as families focus on safeguarding their capital for future generations rather than simply managing its day-to-day deployment.

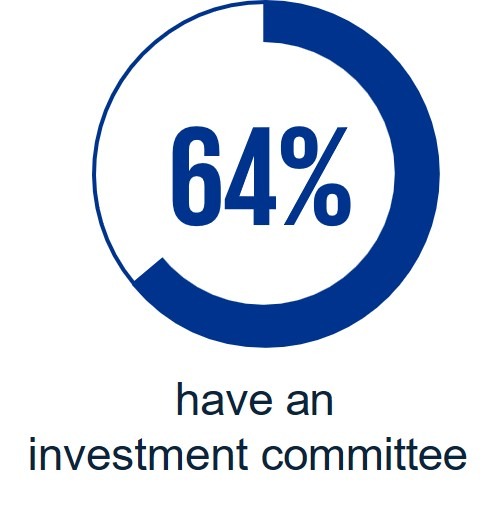

Governance practices have evolved considerably, with Family Offices enhancing the depth and quality of their committees and reporting.

With fewer Family Offices operating within the structure of an active business, there is a broader trend towards professionalization and the separation of personal and business assets. Additionally, macroeconomic concerns have triggered emphasis on appropriate diversification, managing liquidity, and Investment governance.

Other key insights include:

Explore more insights by reading the full report, where you will discover:

- Trends shaping compensation, recruitment, and governance in Family Offices

- Regional benchmarks across roles and functions, from entry-level to C-Suite

- Practical data to guide your strategies

Key Contacts

Tayyab Mohamed

Co-Founder of Agreus Group

tayyabm@agreusgroup.com

Paul Westall

Co-Founder of Agreus Group

paulw@agreusgroup.com